Contents:

After two months of Forex trading strategies live on a demo account, you will see if your system can truly stand its ground in the market. For example, you could make it a rule that if your indicators happen to reverse to a certain level, you would then exit out of the trade. Some people are more aggressive than others and you will eventually find out what kind of trader you are.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This number can help you identify the strategy with the highest returns and the lowest level of risk possible. Profit factor – gross profit / gross loss – to know if and how a trading strategy is profitable and adapted to the trader’s risk tolerance. Swing trading requires a lot of patience, as you’ll be holding your trading positions – normally with a fair degree of leverage – for several days or weeks. It’s ideal for engaged part-time traders, as they don’t always have the time to analyse the market every day.

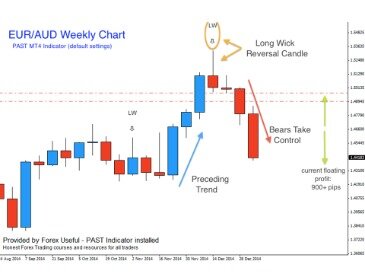

It employs the standard MT4 indicators, EMAs , and Parabolic SAR that serves as a confirmation tool. Those, who have been pushing the market in one direction, should start taking the profit in a month. The matter is that what period you should take to compare the relative length of candlesticks. Then, again expect the beginning of the week and place a new order. Next, choose the pair with the longest distance between the opening and closing prices within the week.

Best Forex Trading Strategies in 2023 – 2024

If you like to analyse the markets without any rush, and are comfortable with running positions for days or even weeks – swing trading might be the right trading style for you. It also gives you the opportunity to include fundamental analysis – which is futile to do when scalp trading. Traders using this strategy must look for trading instruments that are not trending. To do so, you may simply look at the price action of the instrument, or use indicators such as the moving average and the average Ddrection index . We all know that forex trading can be tricky to begin, but finding the right forex strategies to trade with is the key for beginner traders entering the forex market. Pip is an acronym for “percentage in point” or “price interest point.” A pip is the smallest price move that an exchange rate can make based on forex market convention.

Forex position trading is more suited for those who cannot dedicate hours each day to trading but have an acute understanding of market fundamentals. Traders who use this elaborate strategy often swear by it and use it exclusively. When combined with other indicators, such as pivot lines, it provides a stronger signal.

Hedging forex

A breakout occurs when the market price ‘breaks out’ from a consolidation or trading range – this is typically when a support or resistance level has been met and surpassed. The placement of stop-losses is also determined by this strategy. The strategy uses a 20-period exponential moving average or the central line of the Bollinger band indicator . If the price is above the EMA, it is taken as a sign that it will decrease soon, and if the price is below the EMA, it is seen as a sign that it will increase in the near future.

https://forex-world.net/ that retain some uncertainty and cannot be easily formalized into mathematical rules are called discretionary. They are also prone to emotional errors and various psychological biases. Newbie currency traders should probably stay away from discretionary trading, or at least try to minimize the extent of their discretion in trading. Typically these positions are either taken in the currency futures market – where funding is priced in – and with a prudent amount of leverage. Position traders might only do their analysis every month or so and are seeking to identify and trade big trends. Scalping in the FX marketis about buying and selling currency pairs with a target ofa few pips, held for no more than a few minutes, or even seconds.

Trending Articles

I recommend setting a stop loss at a distance of points in four-digit quote. Occasionally, the LWMA may send an early signal in the long run. But this strategy considers only the MA position relative to the price movements. AxiTrader is 100% owned by AxiCorp Financial Services Pty Ltd, a company incorporated in Australia . Over-the-counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage.

Top 5 Forex Trading Strategies in 2022 – Suffolk Gazette

Top 5 Forex Trading Strategies in 2022.

Posted: Mon, 22 Aug 2022 07:00:00 GMT [source]

At the signal candlestick, the green line of the DSS of momentum is above the dotted line. It allows you to identify the breaks in the trend a little earlier than the ordinary MA. The line’s colour and its location changes when the price breaks through its former trendline. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

Live prices

There is no right answer here, except to say the more the better. This is a feature of how much historic data you can get your hands on, how often your strategy triggers a trade to forward-test and how much time you have to spare to test. Let’s say your trading system wins 70% of the time (therefore losing 30% of the time), while your average win is about 5%, while your average loss is about 17%. Let’s say that your trading system wins 40% of the time (therefore losing 60% of the time). Your average win is about 10%, while your average loss is about 5%. Another important thing to understand is that you don’t need to target the highest win rate possible, because this isn’t necessarily indicative of a high performing strategy.

It is also one of the most referred to metrics and it’s used to both identify an upward or downward trend and also measure the strength of the trend. With position trading, you might trade using a daily timeframe. With swing trading, you may stay in position from a couple of days to a few weeks, while using 4-hour to daily charts. With scalping and day trading you will stay in a position anywhere from a few seconds to a day, using anything from tick to hourly charts. To make a profit, the position trader has to identify the right entry and exit prices.

Like all financial markets, there is no free money in forex trading. However, the simplest strategy from a mechanics perspective is simply speculating that one currency will rise or fall in value relative to another. Of course, if you gauge the direction of the bet wrong, you could lose money. Swing trading anticipates rapid price movement over a wide price range—two factors that suggest high profit potential.

- They might use anything from a H1 to a D1 chart, or even weekly.

- It’s absolutely necessary for traders to act fast, but you can choose to wait for the bearish rejection bar that confirms the signal.

- In our eyes, this is the best forex trading room available right now.

- In one, set the time period to 50 days, in the other, set the time period to 200 days.

A trendline is a technical analysis tool used to frame a trend and determine support and resistance levels. Ranging trading is a short- to medium-term buy-and-hold strategy. Traders typically predict a maximum high or low a currency pair can hit in the near term, which forms the resistance and support levels. Day traders looking to maximize intraday profits often use one or multiple of the following day trading strategies. Another way to exit is to have a set target, and exit when the price hits that target. For example, some traders choose support and resistance levels as their targets.

Manual systems involve a trader sitting in front of a computer screen, looking for trading signals and interpreting whether to buy or sell. Automated systems involve a trader developing an algorithm that finds trading signals and executes trades on its own. The latter systems take human emotion out of the equation and may improve performance. Position traders are likely to monitor central bank monetary policies, political developments and other fundamental factors to identify cyclical trends. Successful position traders may open just a few trades over the entire year.

The idea behind it is that the trading instrument will continue to move in the same direction as it is currently trending . In a trending market, price will continue to break previous resistance levels , creating a stair-like support and resistance pattern. In a ranging market, however, price moves in a sideways pattern and remains bracketed between established support and resistance thresholds. Varying time periods (long, medium, and short-term) correspond to different trading strategies.

“Profit Parabolic” trading strategy based on a Moving Average

Most range traders will use stop losses and limit orders to keep their trading in line with what they perceive to be happening in the market. A day trader who is using this strategy and is looking to go short will sell around the high price and buy at the low price. Day trading is another short-term trading style, but unlike scalping, you are typically only taking one trade a day and closing it out when the day is over.

How to day trade forex markets – ig.com

How to day trade forex markets.

Posted: Fri, 13 Jan 2023 10:35:45 GMT [source]

The same applies to a low win rate – having a low win rate doesn’t necessarily mean that you’re losing money. Trading expectancy is all about the average amount of money you can expect to win/lose per trade. Knowing how much your system can generate will definitely help you better manage your expectations and emotions. In any case, the main goal of back-testing and paper trading is to test the proficiency and adeptness of your strategy and its capacity to maintain winning trades with positive gains.

Forex Trading Strategies – ForexLive

Forex Trading Strategies.

Posted: Wed, 15 Jun 2022 07:00:00 GMT [source]

Back-testing is the testing of your trading strategy on a set of historical data, as if you were trading at that time using your selected strategy. Once you know which kind of market analysis to use with your trading style, you have to spot and understand the market phases. There are different tools and indicators that work best under certain market conditions. There are a few types of analysis that could be a good fit for your personality.

Position trading is reserved for more patient traders with a background in finance and economics as they look to profit from long-term market trends. A popular advice in this regard is to set a risk limit at each trade. For instance, traders tend to set a 1% limit on their trades, meaning they won’t risk more than 1% of their account on a single trade.